Global GDP 2025 | Published: Jun 09, 2025 | Category: Economic Monitoring | Reading Time: 8 minutes

The global economy is sending mixed signals as we navigate through 2025, with growth patterns that would have been unthinkable just a decade ago becoming the new normal. While the world has avoided the recession many economists predicted for 2024, the underlying economic fundamentals reveal a troubling picture of persistent weakness and mounting vulnerabilities.

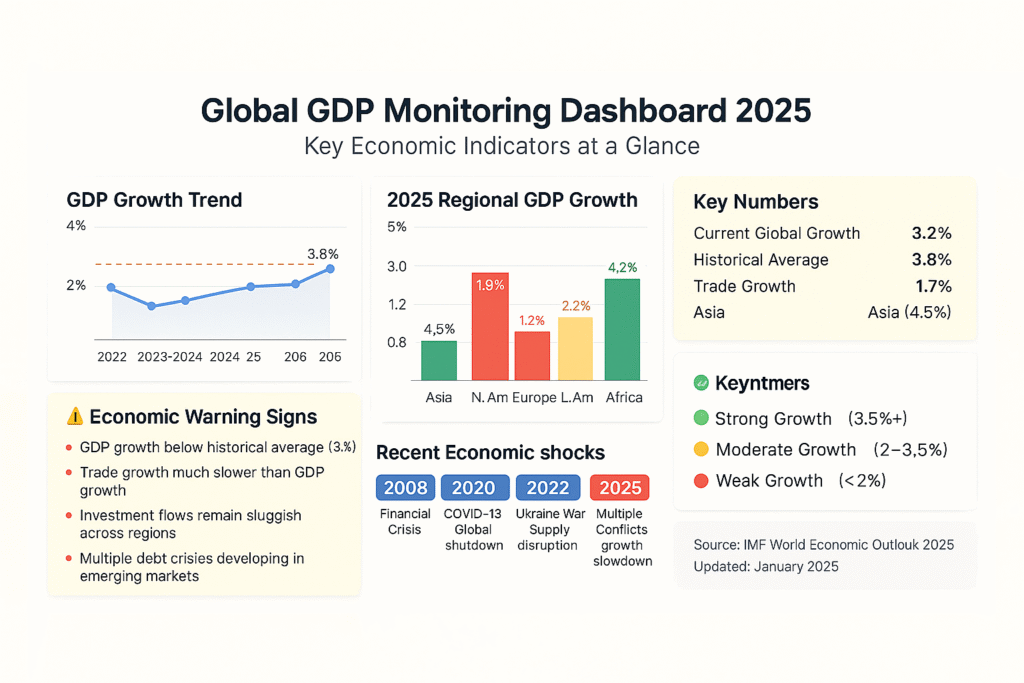

Current projections indicate that global GDP growth will remain steady at 3.2% annually for both 2024 and 2025—a figure that may seem respectable at first glance but represents a significant decline from the 3.8% average growth rate enjoyed from 2000 to 2019. This seemingly modest difference masks a profound shift in the global economic landscape, one that demands our immediate attention and careful monitoring.

Why does GDP tracking matter more than ever in these uncertain times? Because beneath the surface of seemingly stable growth rates lie warning signs that could signal more dramatic economic shifts ahead. From trade volume declines to investment stagnation, from geopolitical tensions affecting supply chains to demographic changes reshaping labor markets, the indicators we monitor today will determine whether we’re heading toward sustained stability or preparing for more turbulent waters.

The Current Global GDP Landscape: A Deceptive Stability

The International Monetary Fund’s latest forecasts paint a picture of economic resilience that deserves closer examination. The projected 3.2% global growth rate for 2025 represents what economists call a “new normal”—a period of sustainably lower growth that reflects fundamental changes in the global economy rather than temporary cyclical factors.

This shift becomes more pronounced when we consider the trajectory we were on before the COVID-19 pandemic disrupted global economic patterns. The pre-2020 growth average of 3.8% wasn’t just a number—it represented an economic ecosystem characterized by robust international trade, steady technological advancement, and relatively predictable policy environments. Today’s lower baseline reflects a world where many of these supporting factors have been permanently altered.

The most concerning aspect of current GDP projections isn’t the absolute numbers but their composition. While headline growth appears stable, the underlying drivers reveal significant imbalances. Consumer spending, traditionally the engine of economic growth in developed nations, remains constrained by persistent concerns about inflation and wage stagnation. Business investment, crucial for long-term productivity growth, has been dampened by policy uncertainty and supply chain disruptions.

Manufacturing activity, a key leading indicator of economic health, shows particular weakness across major economies. The global manufacturing Purchasing Managers’ Index (PMI) has remained below the 50-point threshold that separates expansion from contraction for extended periods, suggesting that the foundation of global trade—physical goods production—continues to struggle.

Perhaps most tellingly, the services sector, which has been carrying much of the growth burden since the pandemic, is beginning to show signs of fatigue. Service sector PMIs, while generally above 50, have been trending downward in key economies, indicating that even this reliable growth engine may be losing momentum.

Key Warning Signs Every Economic Observer Should Monitor

The art of economic forecasting lies not just in tracking headline GDP figures but in identifying the early warning signals that can predict future economic direction. In 2025, several critical indicators deserve particular attention from policymakers, investors, and business leaders.

Investment Flow Stagnation represents perhaps the most significant concern for long-term economic health. Gross fixed capital formation—the technical term for business investment in productive assets—has failed to return to pre-pandemic levels in many major economies. This matters because today’s investment becomes tomorrow’s productive capacity. When businesses delay or cancel investment plans, they’re essentially betting against future economic growth.

The reasons for this investment hesitancy are complex but identifiable. Policy uncertainty, particularly around trade relationships and regulatory frameworks, has created an environment where businesses prefer to wait and see rather than commit capital to long-term projects. The uncertainty surrounding artificial intelligence regulation, climate policy implementation, and international trade agreements has created what economists call “policy pause”—a period where rational actors delay major decisions until the policy environment clarifies.

Trade Volume Decline presents another critical warning sign. While global GDP is projected to grow at 3.2%, trade volumes are expected to expand by only 1.7%—a significant divergence that suggests the global economy is becoming less integrated rather than more connected. This “deglobalization” trend, while politically popular in some quarters, historically correlates with reduced economic efficiency and slower growth.

The trade-GDP growth gap indicates that countries are increasingly sourcing goods and services domestically or from regional partners rather than seeking the most efficient global suppliers. While this may enhance supply chain resilience, it typically comes at the cost of economic efficiency and innovation diffusion.

Consumer Confidence Indicators provide crucial insights into future spending patterns. Current consumer sentiment surveys across major economies show persistent pessimism about future economic conditions, even in countries with relatively low unemployment rates. This disconnect between current economic performance and future expectations suggests that consumers are preparing for economic difficulties that may not yet be reflected in official statistics.

Manufacturing Activity Indices across regions tell a story of persistent weakness in the global goods-producing sector. The manufacturing sector serves as a crucial economic multiplier—each manufacturing job typically supports multiple service sector positions, and manufacturing productivity improvements often drive economy-wide gains. Current trends suggest this engine of economic growth remains under stress.

Employment-to-Population Ratios reveal hidden weaknesses in labor markets that traditional unemployment rates may miss. While unemployment rates remain relatively low in many developed economies, the share of working-age adults participating in the labor force has not fully recovered to pre-pandemic levels. This suggests that official unemployment statistics may be understating the true extent of labor market slack.

Regional Economic Performance: A Tale of Diverging Fortunes

Understanding global GDP trends requires examining how different regions are performing and what their trajectories suggest for the overall global economy. The regional picture reveals significant disparities that could reshape global economic leadership in the coming years.

The United States continues to demonstrate relative economic resilience, but policy uncertainty is beginning to take its toll. The American economy benefits from domestic energy production, technological innovation, and flexible labor markets. However, the implementation of new trade policies and their uncertain duration has created challenges for businesses planning long-term investments. Consumer spending remains robust but shows signs of becoming more selective, with households prioritizing essential goods and services while reducing discretionary spending.

The U.S. manufacturing sector faces particular pressures from reshoring initiatives that, while politically popular, often come with significant cost increases that haven’t yet been fully absorbed by the economy. The service sector continues to perform well, driven by technological innovation and domestic demand, but early indicators suggest this strength may be moderating.

The European Union faces a complex web of challenges that make GDP forecasting particularly difficult. The ongoing adjustment to post-Brexit trade relationships, energy security concerns following geopolitical tensions, and the fiscal constraints of monetary union membership create a challenging environment for sustained growth.

European manufacturing has been particularly affected by energy cost increases and supply chain disruptions. The region’s commitment to green energy transition, while necessary for long-term sustainability, creates short-term economic adjustment costs that are reflected in current growth projections. However, the EU’s strong institutional framework and coordinated policy response capabilities provide important stabilizing factors.

China’s Economic Trajectory presents perhaps the greatest uncertainty in global GDP projections. The world’s second-largest economy faces demographic challenges from an aging population, property sector adjustments, and the ongoing effects of geopolitical tensions on trade relationships. China’s growth model, historically dependent on export manufacturing and infrastructure investment, is undergoing fundamental changes that make traditional forecasting methods less reliable.

Chinese domestic consumption, crucial for rebalancing the global economy, shows mixed signals. While urban household income continues to grow, consumer confidence remains subdued, and household savings rates have increased, suggesting that Chinese consumers are preparing for uncertain economic times rather than driving robust domestic demand.

Emerging Market Economies face a particularly challenging environment in 2025. Higher interest rates in developed economies have reduced capital flows to emerging markets, just as these countries face increased costs for essential imports and debt service obligations. Many emerging market currencies have weakened significantly, making imports more expensive and potentially triggering inflationary pressures that could require contractionary monetary policies.

The divergence between emerging market performance and developed economy stability represents a significant shift from historical patterns where emerging markets often led global growth during difficult periods. This change suggests that the global economy may be less resilient to shocks than in previous decades.

Economic Indicators Dashboard: Tools for Real-Time Monitoring

Effective GDP tracking in 2025 requires access to real-time data sources and understanding how to interpret often-conflicting signals from different economic indicators. The modern economy moves too quickly for quarterly GDP reports to provide timely guidance for decision-making, making alternative indicators crucial for understanding economic direction.

Leading Indicators provide the earliest signals of economic direction changes. The Conference Board’s Leading Economic Index, composite indicators from OECD countries, and sector-specific leading indicators offer insights into where the economy is heading rather than where it has been. In 2025, particular attention should be paid to business confidence surveys, new business formation rates, and capital goods orders—all of which provide insight into private sector expectations about future economic conditions.

Coincident Indicators help confirm whether economic trends are developing as leading indicators suggest. Employment data, industrial production indices, and real-time consumer spending data provide contemporaneous evidence of economic activity levels. The challenge in 2025 is that many traditional coincident indicators are being affected by structural changes in how people work and consume, requiring more careful interpretation than in previous periods.

Lagging Indicators help confirm whether economic changes are permanent or temporary. Unemployment rates, inflation measures, and corporate earnings data typically change after economic trends are already established but provide crucial confirmation of economic direction.

The key to effective economic monitoring in 2025 lies in understanding how these different indicator types interact and what their relationships reveal about underlying economic health. For example, when leading indicators suggest economic weakness but lagging indicators remain strong, it often signals that economic challenges are approaching but haven’t yet been fully reflected in official statistics.

Data Reliability Challenges have become increasingly important in an era of rapid economic change and political sensitivity around economic data. Some regions face questions about the accuracy and timeliness of official economic statistics, making alternative data sources, such as satellite imagery of economic activity, real-time transaction data, and social media sentiment analysis, increasingly valuable for economic monitoring.

Conclusion: Navigating Economic Uncertainty in 2025

The global economy in 2025 presents a complex picture that defies simple characterization. While headline GDP growth appears stable, underlying indicators suggest an economy operating under significant stress from multiple directions. The warning signs we’ve examined—from investment hesitancy to trade volume declines, from regional disparities to data reliability challenges—paint a picture of an economic system that, while not in immediate crisis, faces significant vulnerabilities.

The most critical warning signs to monitor include the persistent gap between trade growth and GDP growth, which suggests ongoing economic fragmentation; the weakness in business investment, which threatens future productive capacity; and the regional disparities that could create new sources of global economic instability.

For policymakers, these trends suggest the need for coordinated international responses that address the root causes of economic uncertainty rather than just the symptoms. For businesses, the current environment requires increased attention to scenario planning and risk management. For investors, the mixed signals suggest a more selective approach to opportunities and increased emphasis on downside protection.

The timeline for potential economic shifts remains uncertain, but the convergence of multiple stress factors suggests that the coming 12-18 months will be critical for determining whether the global economy can navigate current challenges or faces more significant disruptions.

As we continue to monitor these developments, understanding the relationship between different economic indicators and maintaining access to real-time data sources will be crucial for making informed decisions in an increasingly complex global economic environment.

For weekly updates on global economic indicators and analysis of emerging trends, subscribe to our Economic Monitoring newsletter. Follow us on social media for real-time commentary on breaking economic developments.

Related Articles:

- Inflation Analysis: How Rising Prices Impact Different Regions

- Market Volatility in 2025: Causes and Consequences

- Trade Disruption and Global Supply Chains

Data Sources: International Monetary Fund, World Bank, OECD Economic Outlook, Conference Board Leading Economic Index, Regional Central Bank Reports

Recent Comments